The airline industry is a sector that I would normally never consider investing in, mainly due to the industry's overall headline risk, high debt levels and a debilitating dependency on fluctuating fuel prices. As a fellow contributor recently pointed out, it has been a notoriously difficult industry for the investor to navigate successfully. Over the last five years the industry has been especially unkind to investors, as almost all of the major airline equities have lagged significantly behind the general indices. Alaska Air Group (ALK) is a rare exception; its stock is up an extraordinary 300% since 2008.

Alaska Air Group is the holding company for Alaska Airlines and Horizon Air. The company primarily offers full-service and short-haul commuter service flights along the Pacific Coast. Alaska Airlines is the primary method of flight between Alaska and mainland United States, carrying more passengers between the two than any other airline. In total, the company services over 90 destinations in the United States, Canada and Mexico.

I first became aware of the company from my grandmother at the beginning of 2012. She received a letter from her broker notifying her of a stock split on certificated ALK shares that her late husband had purchased in the late 1970's. Never even realizing he had bought the shares in the first place, she was unsure of what to do with them. Knowing my interest in finance, she asked me to do some research on the company to help her decide whether or not she should keep the shares or sell them and take the 30-years worth of profit.

My first inclination was to sell the shares as I felt the money could be put to better use in another equity, one that I fundamentally understood better and one that was not subject to the type of volatility inherent in the airline industry. However, knowing my grandfather, who was the greatest businessman I have ever known, I wanted to know what he saw in the company all those years ago. And while I could not go back far enough to see the numbers he would have been looking at, I have developed an understanding as to why Alaska Air Group has vastly outperformed its peers as of late.

I'm approaching the airline industry from a growth investor's perspective. My objective is to find the company in the industry that has been the most consistent with regards to growth (revenue and EPS) and business fundamentals. Keeping my grandmother in mind, I wanted to find the company that offered as little risk and volatility as possible. I have included a wide range of airlines, big and small, new and old and everything in between. Let's see how Alaska Air Group stacks up to its competition:

Growth:

Company/Ticker

ALK

DAL

HA

JBLU

LCC

LUV

SKYW

UAL

Revenue Growth (2011)

11.34%

10.57%

25.95%

19.05%

9.7%

29.4%

31.7%

59%

Revenue Growth (2012)*

7.6%

4.36%

19.5%

11%

5.9%

9.4%

-3.1%

0.1%

Revenue Growth (2013)*

6.9%

2.73%

14.6%

8.6%

4.3%

4.8%

-3.3%

3.6%

EPS Growth (2011)

-3.35%

44.3%

-100%

-9.7%

-83.5%

-62.3%

-100%

109%

EPS Growth (2012)*

20.4%

29.8%

37.6%

41.4%

299%

23.3%

275%

-53.6%

EPS Growth (2013)*

15.5%

38.3%

13.7%

46.3%

15.9%

83%

42.9%

139%

* Growth rates include future estimates in listed fiscal year

The table immediately shows the volatility in the airline sector with regards to revenue and earnings-per-share growth, both trends are all over the place. I have avoided giving average growth rates here because revenue/earnings in the industry swing wildly and do not give an accurate, historical depiction.

Alaska Air Group offers nice revenue growth going forward but it is not as robust as it has been the last two years (dropping to a projected 6.9% for 2013 from 11.34% in 2011). However, ALK's projected 2013 revenue growth lags behind only Delta Air Lines Inc (DAL) and Hawaiian Holdings Inc. (HA). However, the EPS growth is projected to be an impressive 20% for 2012, rebounding nicely from a negative 2011 growth rate, and is projected to remain robust, at 15.5% for 2013.

There is one company that should be eliminated from the onset, as the growth history is very poor (click on the corresponding name to view growth): US Airways Group Inc. (LCC) has a constant history of negative/decelerating earnings-per-share growth and should not be considered for any long-term growth investor averse to serious risk.

Fundamentals:

Company/Ticker

ALK

DAL

JBLU

HA

LUV

SKYW

UAL

Market Cap

3.2B

11.5B

1.74B

339.16M

8.31B

697.6M

8.24B

Total Debt

1.1B

13.1B

2.9B

674.24M

3.23B

1.7B

12.2B

Total Cash

1.2B

3.24B

1.06B

8.44M

3.2B

14M

6.7B

P/E (TTM)

10.06

8.1

13.13

4.44

17.32

36.01

N/A

Forward P/E

8.56

5.38

10.2

4.96

11.61

10.47

6.41

Return on Capital

8.8%

4.6%

2.7%

7.2%

3.7%

0.5%

-0.9%

Profit Margin

7.35%

3.92%

3.04%

4.08%

3.01%

3.27%

-.65%

First and foremost, the above table shows the extreme amounts of debt that most of the airlines companies carry. Delta, JetBlue Airways (JBLU), Hawaiian Holdings, SkyWest Inc. (SKYW) and United Continental (UAL) currently have debt levels that are unacceptable for any long-term growth investor, as all three companies are burdened with debt that is greater than their respective market capitalizations.

The only two companies that look healthy with regards to debt are ALK and Southwest Airlines Co. (LUV). However, the edge goes to ALK, as it has significantly reduced its debt in the last three years from 1.7 billion in 2009 to 1.1 billion in 2011. LUV's debt level has basically remained flat over the same three-year time span. To separate these two and determine which is the better company, we need to look at the remaining criteria.

A look at the all-important ROIC, return on invested capital, metric reveals just how crippling the debt has been for most airlines. ALK is the only company that is able to efficiently generate respectable returns from its use of capital. As a growth investor I like to see ROIC at no less than 10% because I demand clear proof that a company is able to invest in its operations successfully and efficiently. Although ALK does not meet my 10% standard, the results show that it is by far the most efficient company listed above. LUV, as well every other airline listed in the table above, simply does not make very efficient use of its capital.

ALK also has the highest profit margin out of the remaining airliners, at 7.35%, almost double all other included companies. Add in a very attractive forward P/E ratio of 8.5, especially considering Alaska Air Group is projected to grow revenue by 6.9% and EPS by 15.5% in 2013, and the stock appears to be the best and most consistent growth opportunity in the industry.

In a challenging sector such as this, outperformance in almost all meaningful areas is indicative of great leadership and management. The company's track record speaks for itself and its past success leads me to believe that the company will continue to outperform the majority of its peers. While it may not offer investors the fast, explosive returns that something like a turnaround story may offer, judging by past performance ALK is the only stock I can recommend buying long-term in the airline industry.

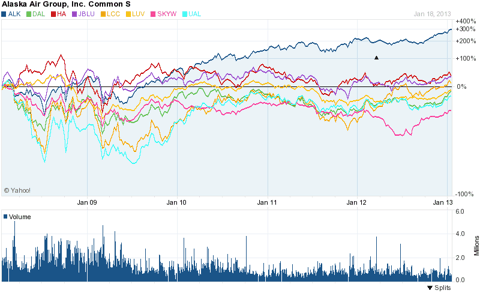

Let's take a look at the charts to see just how disparate ALK's outperformance has been recently:

Charts:

The following is a Yahoo! Finance chart of all aforementioned airline stocks over the last five years:

(click to enlarge)

Here is a breakdown of all eight stocks' percentage returns over the last five years:

ALK: 299%

DAL: -10%

HA: 34.7%

JBLU: 32.1%

LCC: 11.7%

LUV: -6.7%

SKYW: -44.9%

UAL: -24.7%

Clearly, Alaska Air Group has been the standout of the group over the last half-decade and I believe this is because the company has maintained a very conservative balance sheet while offering consistent growth. But will the growth continue? And what will drive it?

Growth Catalysts:

As a growth investor, I like all of my companies to have an edge among their competitors. With regards to airliners, two real competitive advantages these companies can possess are an ability to effectively control costs and an ability to command customer loyalty through a high satisfaction rate. Luckily, Alaska Air does both. Let's begin with the latter. Alaska Air has had the highest customer satisfaction rate in the 'traditional network carrier segment' for the last five years, as measured by J.D. Power and Associates (excludes low cost carriers). The company, along only with Air Canada, carries J.D. Power's coveted five-star rating.

In an industry that is notorious for bad customer service experiences, it is incredibly important to stand out as one of the best -- and Alaska Air definitely does. The high ratings indicate that the majority of customers enjoy traveling with Alaska Air and that can only serve to drive more business the company's way. In very simple terms: chances are if a person is traveling to Alaska from somewhere in the U.S., then they are most likely doing so on Alaska Air and they will continue to do so.

As mentioned prior, the company also has an ability to effectively manage costs, outside of fuel. Its mainline CASM (Cost per Available Seat Mile) has declined for the past three years in a row, from $8.26 in 2009 to $7.60 in 2011. The company expects that number to drop another 0.5% for 2012. Alaska Air has achieved these reductions through what management refers to as "productivity improvement, operational excellence and overhead reduction."

Despite constant headwinds in the industry, the company copes with fuel costs rather well. The first way it manages to do this is by maintaining a young and fuel-efficient fleet of aircraft. In 2011, Alaska Air had the second youngest fleet in the air, with an average plane age of 8.8 years (JetBlue had the youngest with an average of 6.1 years). The properly maintained, young fleet has decreased the company's fuel burn on a gallons/ASM basis each year, falling 16% in the last eight years. Secondly, Alaska Air has a "consistent hedging program that caps oil prices" through futures contracts but allows the company to take advantage of declining prices (details are available in the company's most recent investor presentation).

The company has also been actively buying back shares; it announced a $250 million share repurchase program in September 2012. The recently announced program is expected to be complete by December 2014. In its latest investor presentation, the company estimates the "share count has declined approximately 13%" (net of dilution since repurchases began). The company also boasts one of the strongest liquidity positions in the industry; its cash hoard is approximately 26% of the company's revenue as of September 2012, which is third highest in the industry.

Finally, while the company's many flights to Alaska give it a niche market edge, Alaska Air Group has also actively been increasing flights into other markets to expand revenue. In 2001, flights to Alaska made up a whopping 62% of the company's air capacity. The company estimates flights to Alaska will make up 35% of its total capacity for 2012 and is forecasting that number to decrease even further in 2013 to 33%. While the company still retains its edge in Alaska, management is making the company less dependent upon one region by extending its regional footprint.

Risks:

Besides the usual, defined risks associated with every other airliner (headline risk, spike in fuel prices, labor disputes) there is one area in particular that investors need to monitor with Alaska Air Group and that is capital spending. The company has increased capital spending dramatically the last two years as it is increasing the number of new, fuel-efficient planes in its fleet. The company projects spending to be $500 million in 2012, which is a large increase over 2011's $380 million. The company plans to further increase spending for the next three years at least (projections are $530 million for 2013, $665 million for 2014, $850 million for 2015). This means that 2015 cap-ex will be approximately double what it was for 2011. While the money is being deployed to enhance the company's fleet and make it more fuel efficient, the spending should be monitored.

Conclusion:

Other Seeking Alpha contributors believe that the industry will do well in the next year or so, mainly due to a mix of higher fare prices and lower fuel costs. While I tend to agree I can only recommend that investors purchase Alaska Air Group, as it is the only company that I researched in the sector that has a more recent and proven history of successful management, not to mention a proper balance sheet. The company stands to benefit from the macro trends that will positively affect all other airliners but it carries with it a lot less risk. I recommend waiting for the company to announce earnings and provide guidance on January 24, 2013 before purchasing. If projections remain the same, or are raised, then I believe investors will do well purchasing shares of ALK for the long-term.

On a personal note, after I told my grandmother that I believed she would do well keeping the shares, she agreed and told me that they were mine to own if I wanted them. As of June 2012, I have been an owner of ALK. I have recently added to my shares, as I believe Alaska Air Group will continue to fly high!

Disclosure: I am long ALK. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

This article was sent to 327 people who get email alerts on . Get email alerts on » This article was sent to 210,903 people who get the Investing Ideas newsletter. Get the Investing Ideas newsletter » About the author: Philip Saglimbeni

About the author: Philip Saglimbeni  Learning more about personal finance every day. My primary focus is long-term growth stocks but I do trade options every now and then. I'm open to all ideas. I am a small business owner and real estate manager in New York City. I graduated from NYU's School of Journalism and Mass Communications.... More Blog: The Idea Share Book: Growth Investing: Finding the Perfect Stock for You Philip Saglimbeni Articles (4) Instablog (1) StockTalks (126) Comments (81) Profile 11 Followers 8 Following Send Message

Learning more about personal finance every day. My primary focus is long-term growth stocks but I do trade options every now and then. I'm open to all ideas. I am a small business owner and real estate manager in New York City. I graduated from NYU's School of Journalism and Mass Communications.... More Blog: The Idea Share Book: Growth Investing: Finding the Perfect Stock for You Philip Saglimbeni Articles (4) Instablog (1) StockTalks (126) Comments (81) Profile 11 Followers 8 Following Send Message Philip Saglimbeni

Stop FollowingPhilip Saglimbeni

TOP AUTHORS: The Opinion Leaders TOP USERS: StockTalkers | Instabloggers RSS Feeds | Contact Us | About Us | Premium Program Terms of Use | Privacy | Xignite quote data | © 2013 Seeking Alpha Follow @SeekingAlpha

TOP AUTHORS: The Opinion Leaders TOP USERS: StockTalkers | Instabloggers RSS Feeds | Contact Us | About Us | Premium Program Terms of Use | Privacy | Xignite quote data | © 2013 Seeking Alpha Follow @SeekingAlpha