Buy CVS because it is one of the few stocks that provides the potential for capital gains, pays a steady and constantly improving dividend, and also steadily grows income. This baseball equivalent of the triple play is rare, because high yielding dividend stocks are usually from companies that mutedly admit to not having better alternative uses of their cash. This is not the case of CVS Caremark Corp. which has delivered a 21.13% change in the last 52 weeks and 5% already this year. CVS operates in a sector that is:

1. Adequately resistant to recession (Beta of 0.99).2. Aligned with a culture that favors medication as a first method of treatment.3. Benefits from an aging population.4. Positioned to benefit from a very favorable macro environment.This is a stock that should anchor your portfolio if you, like me, like taking risks, but would like an anchor that has some downside protection.

The Company:

CVS Caremark Corp. is the largest pharmacy healthcare provider in the U.S. by revenue with about 7,423 retail drugstores stores across the U.S followed by Walgreens (WAG). As of December 31, 2011, it operated 657 MinuteClinics in 25 states with plans to grow them to about 1,500 in 35 states by 2017. It also runs online retail operations through CVS.COM and mail pharmacy operations which contributed $19.4B total revenue in 2012.

Macro Environment

Prescriptions/medications are a necessary evil to some and/or a lifestyle choice to others. Either way, the demand for it, is adequately inelastic and in most situations self-perpetuating. Sooner or later, we need them because of wear and tear, repairs, addiction, prevention, and at times for comfort. This inelasticity of demand, and the macro factors below, puts CVS on a strong platform to deliver on the aforementioned triple play of dividends, capital gains, and income growth.

Affordable Care Act (Obamacare) - I add the "Obamacare" terminology with trepidation but with hope that it adds familiarity to the point rather than detract from it. The Affordable Care Act takes full effect in 2014 with the aim of providing access to health insurance to the uninsured and inadequately insured. By the 2011 census numbers, about 15.7% of the total population, or about 48.6M people were uninsured. There are lots of different viewpoints about the extent to which the total of new insured is going to increase but there is unanimous agreement that there will be an increase both in preventative and planned care. An increase in overall care translates to more planned hospital visits which translate to an increase in prescriptions and an opportunity for pharmacies to generate more revenue. Increased foot traffic to pharmacies translates to increased sales for prescriptions, beauty/cosmetics, over-the-counter medication, personal care items, and also general merchandise.Generic Drugs - Insurance companies increasingly steer purchases towards generics by requiring a higher percentage of out-of-pocket payments for branded equivalents. Generics cost less, provide a higher margin, and in some cases help drive in customer loyalty for the retailers when they are able to differentiate with the generic brands they carry.Technology - Technological advancements help pharmacies maximize their operations and increase productivity. Technology helps with everything from pill counting, labeling, prescription tracking, managing inventory and paperwork. Technology also helps with maximizing the development of customized therapies that enhance operational tactics that support unburdened revenue growth. Technology is crucial in retail especially with Customer Relationship Management (CRM) tools that facilitate collection of data to drive both customer satisfaction and repeat sales. If you have been in a retail pharmacy store lately, you must have realized that the pharmacy portion is in the furthest corner in the back of the store, so customers are exposed to a myriad of convenience items before picking up their prescriptions.Income Growth & Capital Gains:

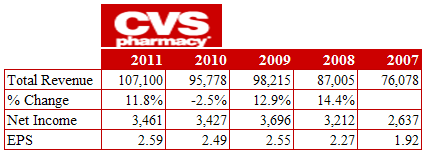

CVS has had double-digit gains in total revenue from 2007 through 2011, with the exception of 2010 when growth declined by 2.5%. To an extent, growth into 2011 was helped by Walgreen's decision not to accept Express Scripts plans which left uncontested customers for CVS and other competing pharmacies. Net income and EPS trended similarly to total revenue declining in 2010, but rebounding in 2011. Its key financial highlights for the trailing twelve months are: ROE of 10.35%, ROA of 6.62%, and revenue per share of $93.34. These numbers compare to Walgreens' ROE of 12.02%, ROA of 6.78%, with revenue per share of $79.44. While revenue per share is higher, the numbers show opportunities to maximize shareholder value and some operational efficiencies. The previously mentioned share buybacks should help attain a better EPS, ROE and revenue per share in the coming fiscal year. Analysts estimate next year's EPS to come in at $3.93, with revenue expected to at $125B which is about a 17% change in total revenue with a surprise factor of 1.20%.

Source: Scottrade

CVS has been a strong performer in the last year with its stock price rallying more than 20%. It has already gained more than 5% so far in 2013 and that trend should continue with high-end estimates of the stock coming in at $60. CVS has broken out of previous support in the $42-$45 range, and also broken out of resistance in the $48-$50. It has not reached this level in 5 years and may reset at about $50 which is slightly above its 50-day moving average of $49.02. Since August 2010, the trajectory of the stock price has been consistently positive setting new highs along the way and showing strong buy momentum.

(click to enlarge)

Source: Yahoo Finance

Dividends

In December of 2012, CVS announced a 38% increase in quarterly dividends to $0.225 per share on the common stock of the company. This increase translates to an annual rate of $0.90 per share, up $0.25 from the previous annual rate of $0.65. The current annualized yield is 1.7%. Dividend growth is an indication of stability and CVS has increased its dividend consecutively for 10 years and at a higher rate since 2007. Stability and low volatility in earnings are indicators for dividend growth. The fact that CVS has been able to increase its dividend, grow revenue and its stock price is indicative of the health of the company.

(click to enlarge)

Source: YCHARTS

Conclusion:

CVS has the leading market share in prescription revenue at 22.8%, which is 7.3% higher than the Walgreens, in second position. This drugstore portion alone is 15.8% of total market share which is important because it provides additional opportunities to cross sell across the store. Apart from Express Scripts (ESRX) at 11.9%, all other competitors are in the single digits in market share. This leading market position and cash levels at $1.24B puts it in a position to grow its retail footprint, acquire competitors if suitable, benefit from an aging population and use technology to maximize its operations. EPS grew by 4.0% from 2010 to 2011, and analysts estimate EPS to grow by 21% into 2012 with earnings rising by 16%. On a scale of 0 -99 with 0 being stable and 99 being erratic, CVS' EPS stability comes in at 4. Previously announced stock buybacks in consecutive years also indicate that management is confident the company should do better going forward. Lastly, new opportunities for preventative care should drive even more business to the MinuteClinics format. The opportunity to service Express Script customers is more important to CVS because it has mail pharmacy operations. Any permanent conversions can boost revenue for CVS more than it would for other competitors.

So, what is in it for you? Increased dividend and stock buyback will provide downside protection and improve the EPS (shout out to Ocean Man on seeking Alpha for the comment on my stock talk) and total revenue per share numbers. Continued revenue growth should boost the stock price which should lead to higher net incomes and open up strategic options for growth. The stock price grew more than NASDAQ and the S&P 500 in the last year. If the earnings release in February meets expectations, the stock should get a good bump and will have "buy" momentum going forward.

For a very aggressive investor, this may not be a stock for you because it might not double in a year. But if you like a stock with a steady beta at 0.99 and which may not suddenly swing to losses, I, like 17 analysts on Yahoo Finance, recommend that you buy CVS for an almost assured and steady return.

Disclosure: I have no positions in any stocks mentioned, but may initiate a long position in CVS over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

Additional disclosure: Regards to Shami for review and Ocean Man for Stock Talk discussion

This article was sent to 2,547 people who get email alerts on . Get email alerts on » This article was sent to 210,903 people who get the Investing Ideas newsletter. Get the Investing Ideas newsletter » About the author: Benedict Tubuo (Beevest)

About the author: Benedict Tubuo (Beevest)  I enjoy analysing companies for strategies that drive sustainable results. I use a proprietary method in selecting stocks for my portfolio that incorporates micro and macro components. I am a semi active trader with a portfolio that spans across different sectors. I am a graduate of the... More Company: Beevest Benedict Tubuo (Beevest) Articles (8) StockTalks (2) Comments (24) Profile 16 Followers 20 Following Send Message

I enjoy analysing companies for strategies that drive sustainable results. I use a proprietary method in selecting stocks for my portfolio that incorporates micro and macro components. I am a semi active trader with a portfolio that spans across different sectors. I am a graduate of the... More Company: Beevest Benedict Tubuo (Beevest) Articles (8) StockTalks (2) Comments (24) Profile 16 Followers 20 Following Send Message Benedict Tubuo (Beevest)

Stop FollowingBenedict Tubuo (Beevest)

About this author:Visit Beevest TOP AUTHORS: The Opinion Leaders TOP USERS: StockTalkers | Instabloggers RSS Feeds | Contact Us | About Us | Premium Program Terms of Use | Privacy | Xignite quote data | © 2013 Seeking Alpha Follow @SeekingAlpha

TOP AUTHORS: The Opinion Leaders TOP USERS: StockTalkers | Instabloggers RSS Feeds | Contact Us | About Us | Premium Program Terms of Use | Privacy | Xignite quote data | © 2013 Seeking Alpha Follow @SeekingAlpha