I've always enjoyed the process of sifting through the financial statements of publicly traded companies looking for situations where the stock market is not correctly valuing a business. I have to admit though that I enjoy that process a lot more when it results in me making a lot of money in a fairly short time period.

I'm starting to think that finding the undervalued companies is the easy part. The much harder part is having to wait for the stock market to agree with my valuation (assuming it is correct).

Doubling my money on an investment in five years is great. Doubling my money on an investment in half that time is better.

To try and shorten the period of time I have to wait for the stock market to recognize true intrinsic value I've decided to focus more on opportunities that have a likely catalyst to expedite the process.

Therefore I've been watching 13D filings on companies as they are filed by activist investors who are willing to get their hands dirty and force value realization for me.

One that caught my attention this week was filed by Iroquois Capital Management LLC on LRAD (LRAD) Corporation.

Here are the juicy details:

The Reporting Persons believe that the Board of Directors of the Issuer has failed to exercise proper oversight over the management and operations of the Issuer and has granted compensation to itself that is excessive.

The Fund filed a Verified Amended Derivative Complaint in November, 2012 against then-directors Raymond Smith, Laura Clague, Helen Adams, and Thomas Brown and the Company's chief financial officer Katherine McDermott ("Defendants") and the Company as nominal defendant, asserting breach of fiduciary duty and other violations of law in connection with Defendants' issuance of stock options for their own benefit representing 3% of the Company's then issued and outstanding shares with incredibly low exercise prices. The Complaint asserts that the issuance of the options was exquisitely timed to follow the announcement of disappointing earnings results and precede material non-public positive earning events and to serve as a replacement for options held by Defendants that had expired, were about to expire, and/or were "out of the money".

The Reporting Persons have determined that they intend to seek to replace the existing Board of Directors at the 2013 Annual Meeting of Shareholders and in connection therewith have delivered to the Issuer the Notice attached hereto as Exhibit 2. The Reporting Persons expect that they will solicit proxies in support of the nominees for director specified in the Notice in accordance with the proxy regulations applicable to such solicitation.

The activist investor (Iroquois) wants to remove the current Board of Directors and its basis for doing so is an inappropriate (in the opinion of Iroquois) option issuance that the Board approved. In the opinion of Iroquois the Board of Directors waited until after releasing a material piece of bad news before it issued a very large (3% of outstanding shares) number of options. The result of the grant timing being options with very low strike prices. The low strike prices represents great news for those receiving the options but is dilutive for the actual owners of the company (shareholders).

The news release in question is this guidance released on April 5, 2012 announcing unexpectedly low revenue:

SAN DIEGO, CA, April 5, 2012 - LRAD Corporation , the world's leading provider of long range acoustic hailing devices (AHDs), announced today that it expects to report fiscal Q2 2012 revenues of approximately $2.4 million for the period ended March 31, 2012.

"We experienced a reduction in quarterly and fiscal first half revenues compared to the prior year due to the continued uncertainty surrounding the U.S. defense budget and a difficult global business environment," remarked Tom Brown, president and CEO of LRAD Corporation. "While our selling cycles can be long and uneven, we are adding to a growing pipeline of potential domestic and international business, focusing in particular on significant AHD military opportunities."

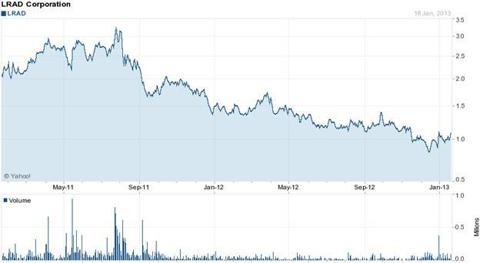

The stock chart below shows that an already sliding stock price accelerated its downward trend subsequent to the announcement:

(click to enlarge)

The filing of the option grants were dated just over a month later (May 10, 2012) and were for the following amounts:

- Tom Brown CEO and Director - Option to purchase 750,000 shares at $1.33

- Katherine McDermott CFO - Option to purchase 100,000 shares at $1.33

- Helen Adams Director - Option to purchase 25,000 shares at $1.33

- Laura Clauge Director - Option to purchase 50,000 shares at $1.33

- Raymond Smith Director - Option to purchase 50,000 shares at $1.33

I have to say, I can see how these grants would not be taken too kindly by shareholders. The company first announces that revenue has plummeted and then the Directors grant themselves options equal to 3% of the company shares outstanding at a strike price that is less than half of where it was a year prior.

There is nothing like setting the bar low when it comes to establishing the hurdle you have to clear in order to get paid.

The table below details the stock price in the period prior to the option grant, and you can see why the boatload of options at $1.33 might be a bit tough to swallow for shareholders:

Sales Prices

High

Low

Fiscal Year Ending September 30, 2011

First Quarter

$

2.81

$

1.36

Second Quarter

$

2.79

$

2.01

Third Quarter

$

2.95

$

2.19

Fourth Quarter

$

3.24

$

1.66

Fiscal Year Ending September 30, 2012

First Quarter

$

2.06

$

1.36

Consider what this option grant could mean for CEO Brown. The share price of LRAD in 2011 hit $3.00 per share. For just getting back to that share price Brown would stand to profit in the amount of 750,000 x ($3.00 - $1.33) = $1.25 million.

That is a big reward for an accomplishment that requires simply returning the stock price to where it was a year prior. It seems an especially generous dollar amount for a company that only generated $197,000 of operating cash flow for the year ended September 2012.

But the bar for these directors is set even lower than it might seem with this first initial look. The expiry date on these options is May 2022. All it would take is a mediocre performance over that long of a time period to put these options deep into the money.

The Activists Have A Case - But Is LRAD An Attractive Investment?

I'm not a big fan of a Board of Directors enriching themselves at the expense of shareholders.

The size and timing of these specific option grants would displease me if I were a shareholder so I'm inclined to think Iroquois has a pretty good chance of taking over this Board of Directors.

That intrigues me as an investor, because Iroquois is going to have a single source of motivation should it control the Board and that motivation is to move the share price of LRAD higher.

But I wouldn't ever invest simply based on a change in a Board of Directors, I also require an attractive valuation relative to the intrinsic value of the business.

The Business

The business that LRAD is described as follows on the company website:

LRAD Corporation develops and delivers innovative directed acoustic products that beam, focus and control sound over short and long distances. By placing sound only where needed, we not only enhance many typical speaker applications, but we offer novel sound applications that conventional speakers cannot achieve. We offer a variety of directional sound products which meet a broad range of requirements from communicating with and deterring threats over distances up to 300 meters with our hand-held LRAD 100X to distances in excess of 3,500 meters with our LRAD 2000X.

That description confuses me a little bit, but some examples of what the product is used for helped provide me with a better idea of what LRAD does:

Large crowd communicationsSearch and rescue operationsInfrastructure and perimeter protectionEnforcing security zones from secure remote locationsSWAT operationsEmergency responder situationsCrowd/riot controlMass notificationCBRN incident responseHostage negotiation from a safe locationServing warrantsFire/HAZMAT evacuation and communicationBasically, LRAD's product allows for effective communication across large spaces to targeted parties and keeps emergency personnel at a safe distance and out of harm's way. Additionally the technology can be utilized as a non-lethal crowd control weapon which is an area with enormous growth potential given the current focus on gun violence in the United States. A perfect example of the growing popularity of non-lethal weapons is how the products from Taser International (TASR) have taken off in the past year. This article explains how the LRAD is used as a non-lethal weapon.

Valuation of the Business

My next question is how predictable the cash flow stream is from this business and whether I have the ability to predict with any precision future cash flow? LRAD's annual income statements for the past two years are presented below.

Years Ended September 30,

2012

2011

Revenues:

Product sales

$

14,218,766

$

26,020,385

Contract and other

573,572

486,436

Total revenues

14,792,338

26,506,821

Cost of revenues

7,313,762

10,577,370

Gross profit

7,478,576

15,929,451

Operating expenses:

Selling, general and administrative

4,541,594

8,463,842

Research and development

1,659,673

2,483,938

Total operating expenses

6,201,267

10,947,780

Income from operations

1,277,309

4,981,671

Other income

33,895

46,967

Income from continuing operations before income taxes

1,311,204

5,028,638

Income tax (benefit) expense

(150,816

)

75,190

Income from continuing operations

1,462,020

4,953,448

Income from discontinued operations, net of tax

-

69,454

Net income

$

1,462,020

$

5,022,902

As noted earlier when discussing the timing of the option grants, the performance of the company has deteriorated in 2012. The biggest reason for the decrease in revenue was that 2011 had one large ($12 million) sale to a foreign government.

For the sake of simplicity I will estimate that cash flow for LRAD will generally match its net income, and that a normal year for the business will result in cash flow / income of $3.2 million which is the average of the last two years.

If I put a 10 multiple on that $3.2 million of cash flow I reach an estimate for the value of the business of $32 million. That is obviously a very quick pass at a valuation effort, but it helps to determine if the company is worth investigating further.

Now, the nice thing about LRAD is the balance sheet which is a thing of beauty compared to many of these micro-caps that I look at.

September 30,

2012

2011

ASSETS

Current assets:

Cash and cash equivalents

$

13,859,505

$

13,870,762

Restricted cash

-

606,250

Accounts receivable, less allowance of $4,372 and $0 for doubtful accounts

5,517,894

5,098,148

Inventories, net

3,112,489

2,735,520

Prepaid expenses and other

441,823

663,601

Assets of discontinued operations

-

6,250

Total current assets

22,931,711

22,980,531

Property and equipment, net

212,863

75,468

Intangible assets, net

158,457

225,969

Prepaid expenses and other-noncurrent

1,102,016

1,218,750

Total assets

$

24,405,047

$

24,500,718

LIABILITIES AND STOCKHOLDERS' EQUITY

Current liabilities:

Accounts payable

$

995,719

$

1,040,202

Accrued liabilities

623,742

2,899,211

Liabilities of discontinued operations

-

9,263

Total current liabilities

1,619,461

3,948,676

Other liabilities-noncurrent

363,817

276,744

Total liabilities

1,983,278

4,225,420

Commitments and contingencies (Note 12)

Stockholders' equity:

Preferred stock, $0.00001 par value; 5,000,000 shares authorized; none issued and outstanding

-

-

Common stock, $0.00001 par value; 50,000,000 shares authorized; 32,374,499 shares issued and outstanding each period

324

324

Additional paid-in capital

86,358,011

85,673,560

Accumulated deficit

(63,936,566

)

(65,398,586

)

Total stockholders' equity

22,421,769

20,275,298

Total liabilities and stockholders' equity

$

24,405,047

$

24,500,718

LRAD has almost $21 million in net current assets and no long term debt. That makes the company considerably more interesting.

Estimate of value per share:

Value of the operating business as estimate earlier - $32 million

Value of cash and net current assets - $21 million

Estimate of Enterprise Value - $53 million

Fully diluted shares outstanding - 33 million

Estimate of value per share - $1.60 per share

Current share price - $1.09

Or, we can look at it another way. The current market capitalization of LRAD is $1.09 x 33 million = $35.97 million. Take the $21 million of net current assets off of this number and it means that the stock market is valuing the entire operating business of LRAD as being worth $15 million.

That isn't much for a business that made $5 million in 2011. And if the Iroquois team has some operation improvements in mind (what activist investor doesn't?) then this really might start to get interesting.

If nothing else, this certainly does appear to be an opportunity that deserves further due diligence.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

This article was sent to 88 people who get email alerts on . Get email alerts on » This article was sent to 210,940 people who get the Investing Ideas newsletter. Get the Investing Ideas newsletter » About the author: Devon Shire

About the author: Devon Shire  Author of the value investing newsletter detailing the formation of the "Punch Card Portfolio" (http://valueinvestorcanada.blogspot.com/). Devon Shire is an accountant and an investor with 15 years experience managing a private portfolio. Devon Shire's preferred portfolio management... More Company: Canadian Value Investing Blog: Canadian Value Investor Book: CVI - Punch Card Portfolio Devon Shire on Basic Materials Articles (298) Instablog (87) Comments (464) Profile 1,500 Followers 15 Following Send Message

Author of the value investing newsletter detailing the formation of the "Punch Card Portfolio" (http://valueinvestorcanada.blogspot.com/). Devon Shire is an accountant and an investor with 15 years experience managing a private portfolio. Devon Shire's preferred portfolio management... More Company: Canadian Value Investing Blog: Canadian Value Investor Book: CVI - Punch Card Portfolio Devon Shire on Basic Materials Articles (298) Instablog (87) Comments (464) Profile 1,500 Followers 15 Following Send Message Devon Shire

Stop FollowingDevon Shire

Single page view page 1 / 2 | Next » TOP AUTHORS: The Opinion Leaders TOP USERS: StockTalkers | Instabloggers RSS Feeds | Contact Us | About Us | Premium Program Terms of Use | Privacy | Xignite quote data | © 2013 Seeking Alpha Follow @SeekingAlpha

Single page view page 1 / 2 | Next » TOP AUTHORS: The Opinion Leaders TOP USERS: StockTalkers | Instabloggers RSS Feeds | Contact Us | About Us | Premium Program Terms of Use | Privacy | Xignite quote data | © 2013 Seeking Alpha Follow @SeekingAlpha