Methodology: To forecast the future by projecting the past into the future

Personally, to find the true value of industrial stock (as opposed to financial or insurance value), the primary focus is on the free cash flow that can be defined as operating cash flow minus capital expenditures. Generally, this free cash flow is what remains after deducting what is strictly needed for survival from all the cash produced by a company in one year. From the point of view of an investor, this free cash flow is what really matters, as it's the real added value that may be entirely distributed to the stakeholders without compromising a company's existence.

By projecting the free cash flow to the future and discounting it back (employing the so-called weighted average cost of capital, after having performed some other technical steps), it's possible to reach the fair value of stock compared with its market price. However, the big issue is to choose an appropriate free cash flow future growth rate. This task can be accomplished by looking back into the financial reports of the target company to see how it performed in the past.

Based on this methodology, Microsoft (MSFT) is now undervalued: The operating cash flow for the last 12 months stands at $31.6B and capital expenditures totaling $2.47B, so the free cash flow is $29.14B with the weighted average cost of capital computed at 14.33%. Using data from the most recent 10-K form, the estimated impact of operating leases and outstanding stock options combined is $1.97B.

A reasonable free cash flow growth rate for the short/medium term (up to 10 years) could be estimated at 2.75%, considering (as a proxy of growth) revenue for the last 15 months at a Compound Annual Growth Rate. This rate happens to be the same as growth rate projections for the overall world economy in the long term (over ten years) or perpetuity growth.

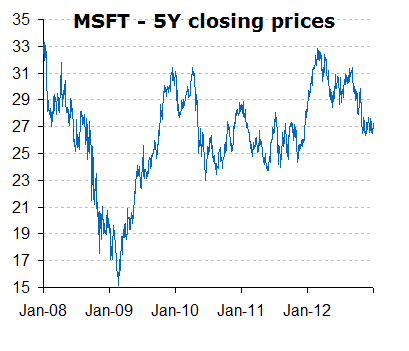

Given all the above-mentioned assumptions, the final calculation gives a value per ordinary share equal to $37.01, which is about 35.8% higher than the closing price of $27.25 on January 18, 2013.

Free cash flow trailing 12 m. ($M)

29,145

Discount rate (weighted average c. of c.)

14.33%

Cash flow growth rate

2.75%

Perpetuity growth

2.75%

Present value of free cash flows ($M)

169,773

Present value of terminal value ($M)

88,989

Value of operating assets ($M)

258,762

Total value of cash & marketable securities ($M)

66,644

Value of Firm ($M)

325,406

Total value of outstanding debt ($M)

11,950

Operating leases/value of equity in options ($M)

1,989

Total Value of Equity ($M)

311,467

Total outstanding shares M

8,416

Estimated Fair Value of one ordinary share

$ 37.01

If cash flow growth rate for the short/medium term (up to 10 years) is placed at -3.3%, then the final calculation gives a value per ordinary share equal to current market price (January 18, 2013).

This is the implied growth rate given by market participants and it sounds a bit too pessimistic, at this stage.

We may for example consider how WINDOWS 8 is performing by comparison with WINDOWS 7:

Operating system market share

WINDOWS 8

WINDOWS 7

September 2012

0.26%

March 2009

0.26%

October 2012

0.35%

April 2009

0.31%

November 2012

0.96%

May 2009

0.56%

December 2012

1.45%

June 2009

0.75%

Source: netmarketshare.com

As you see from the table, WINDOWS 8 is gained momentum at a faster rate than WINDOWS 7 did - bear in mind that during the Q1 2013 Earnings Call on October 18, 2012, MSFT said that the OEM presales revenue for WINDOWS 8 was roughly $800M, which is approximately 40% higher than the presales revenue for WINDOWS 7 in the comparable launch quarter. Additionally, the reach of the 60m licence mark with WINDOWS 8 was disclosed at the JP Morgan Tech Forum at the 2013 International CES on January 8, 2013. So, why was the stock punished, falling almost 17% from the recent peak reached last year at the middle of March?

(data source: yahoo finance.)

A challenging PC market, tough economic conditions in Europe and a significant deceleration of the PC's growth rate in emerging markets (roughly flat), may partially explain the reason. Moreover, for sure, the market didn't like the $6.2B charge for the impairment of goodwill in the Online Services Division business segment announced in July 2012 (a non-cash, non-tax-deductible charge related mainly to goodwill acquired through Microsoft's 2007 acquisition of aQuantive, Inc., thus reducing OSD's goodwill from $6.4B to $223M and increasing Micorsoft's effective tax rate by 10%). The impairment was the result of the OSD unit experiencing slower than projected growth in search queries and search advertising revenue per query, slower growth in display revenue, and changes in the timing and implementation of certain initiatives designed to drive search and display revenue growth in the future (see pages 29, 34, 35, 67 of 10-K form). Nevertheless, don't forget that during the Q1 2013 Earnings Call on October 18, 2012, Microsoft said that revenue grew 9% in the Online Services Division, and Online advertising revenues were up 15%. This was driven primarily by rate improvements in search, and offset in part by a decline in display revenue.

To conclude, Microsoft now looks undervalued, but it's ability to adapt to a challenging environment will be the basis on how it will perform in the long run. This analysis will be updated after Microsoft Fiscal Year 2013 Second Quarter Earnings Conference Call on January 24, 2013.

Disclosure: I am long MSFT. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

This article was sent to 24,976 people who get email alerts on . Get email alerts on » This article was sent to 210,940 people who get the Investing Ideas newsletter. Get the Investing Ideas newsletter » About the author: Plexor

About the author: Plexor  CIIA certificate holder and business owner who has worked several years for leading financial institutions. Passionate about analyzing any kind of stocks to find out their real value (at least what in my opinion is their real value). When good undervalued stocks are found, they are usually... More Plexor Articles (2) Comments (1) Profile 2 Followers 0 Following Send Message

CIIA certificate holder and business owner who has worked several years for leading financial institutions. Passionate about analyzing any kind of stocks to find out their real value (at least what in my opinion is their real value). When good undervalued stocks are found, they are usually... More Plexor Articles (2) Comments (1) Profile 2 Followers 0 Following Send Message Plexor

Stop FollowingPlexor

Single page view page 1 / 2 | Next » TOP AUTHORS: The Opinion Leaders TOP USERS: StockTalkers | Instabloggers RSS Feeds | Contact Us | About Us | Premium Program Terms of Use | Privacy | Xignite quote data | © 2013 Seeking Alpha Follow @SeekingAlpha

Single page view page 1 / 2 | Next » TOP AUTHORS: The Opinion Leaders TOP USERS: StockTalkers | Instabloggers RSS Feeds | Contact Us | About Us | Premium Program Terms of Use | Privacy | Xignite quote data | © 2013 Seeking Alpha Follow @SeekingAlpha